Deutsche Telekom’s Bold Leap: Integrating 5G+ Gaming with NVIDIA GeForce NOW

Deutsche Telekom has launched a new 5G-enabled cloud-gaming offer, integrating NVIDIA’s GeForce NOW platform into its 5G Standalone network

In the ever-evolving landscape of telecommunications, Deutsche Telekom (DT) has emerged as a pioneer in harnessing 5G technology to redefine consumer experiences.

In the ever-evolving landscape of telecommunications, Deutsche Telekom (DT) has emerged as a pioneer in harnessing 5G technology to redefine consumer experiences.

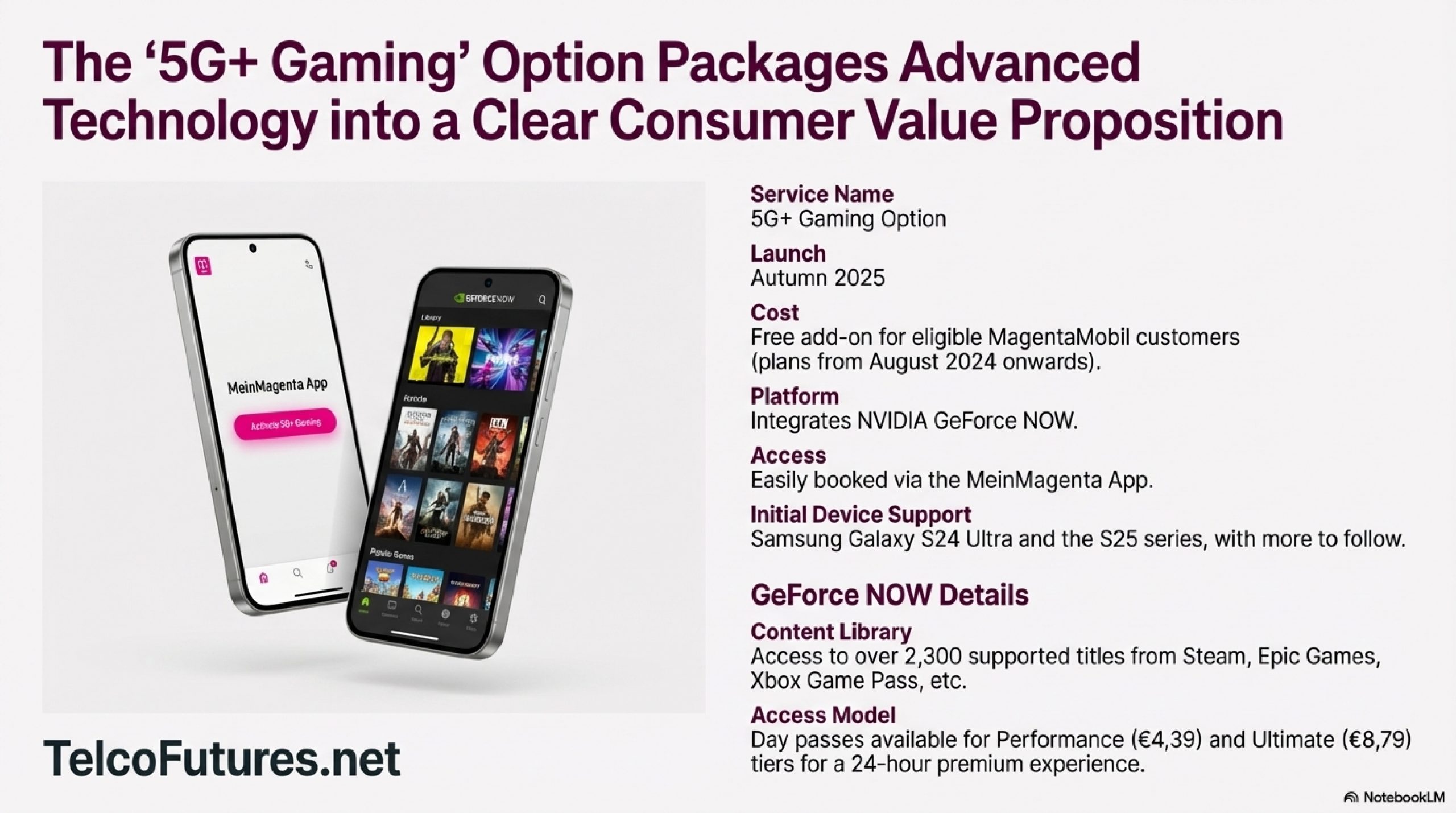

Late in 2025, DT unveiled its “5G+ Gaming” initiative, a groundbreaking partnership with NVIDIA that integrates the tech giant’s GeForce NOW cloud gaming service with advanced 5G network capabilities.

This move isn’t just about faster downloads or bigger data plans; it’s a strategic pivot aimed at transforming telcos from mere connectivity providers into enablers of immersive, high-stakes digital services.

5G Standalone Architecture

By leveraging 5G Standalone (SA) architecture, Network Slicing, and innovative protocols like Low Latency, Low Loss, Scalable Throughput (L4S), DT is addressing the perennial pain points of mobile gaming: latency, jitter, and inconsistent performance. This report summary explores the technical foundations, commercial rationale, market dynamics, and potential hurdles of this ambitious venture, positioning it as a litmus test for the future of programmable networks.

The telecommunications sector in Europe has been in a rut. Despite billions invested in 5G infrastructure, operators like DT have seen stagnant Average Revenue Per User (ARPU). The hype around 5G initially centered on peak speeds—think downloading a movie in seconds—but for everyday users scrolling social media or streaming videos, the difference from 4G is negligible.

Video apps buffer content, masking network flaws, so consumers don’t feel the upgrade. This has led to commoditization, with telcos slashing prices on data bundles while revenues flatline. DT’s response? Shift the focus from quantity (bandwidth) to quality (reliability). Cloud gaming, with its zero-tolerance for delays, is the ideal showcase. A 50-millisecond lag in a game like Fortnite can ruin the experience, turning a seamless battle into frustrating rubberbanding.

By optimizing for this, DT not only appeals to gamers but also proves its network’s mettle for enterprise applications like remote surgery or autonomous vehicles.

Nvidia Partnership

The partnership with NVIDIA marks a significant evolution from DT’s earlier experiments. In 2024, DT dabbled with smaller players like Ludium Lab’s Sora Stream, offering indie and retro games. While functional, it lacked the punch to attract hardcore gamers.

Enter NVIDIA, the undisputed king of graphics processing units (GPUs), commanding over 90% of the discrete GPU market and fueling the AI boom. GeForce NOW, NVIDIA’s cloud gaming platform, boasts 25 million users worldwide and runs on powerhouse servers like RTX 4080 SuperPODs, soon upgrading to RTX 5080.

This collaboration elevates DT’s offering, providing access to AAA titles with ray-traced graphics and high frame rates, all streamed over mobile networks. It’s a symbiotic relationship: DT gains credibility, while NVIDIA secures a stable “last mile” for its service, reducing churn from poor connections.

At the heart of 5G+ Gaming lies a robust technical architecture built on 5G SA, which DT has rolled out to 99% of Germany’s population. Unlike Non-Standalone (NSA) setups that piggyback on 4G cores, SA uses a fully cloud-native 5G Core (5GC). This enables dynamic management of network functions, crucial for identifying and prioritizing GeForce NOW traffic.

Network Slicing

Network Slicing is the star here—carving the physical network into virtual “slices” tailored to specific needs. The default Enhanced Mobile Broadband (eMBB) slice prioritizes throughput for general use, but the gaming slice focuses on Ultra-Reliable Low Latency Communications (URLLC). In a crowded scenario, like a bustling train station, eMBB traffic might queue up, spiking latency. The gaming slice, however, reserves resources or grants priority, ensuring packets zip through without delay.

Complementing slicing is L4S, a protocol DT claims to have deployed first in Europe for consumers. Traditional networks suffer from “bufferbloat,” where routers queue packets during congestion, causing lags in real-time apps. L4S flips this by using Explicit Congestion Notification (ECN).

Routers mark packets at the first sign of buildup, signaling the sender (NVIDIA’s servers) to tweak bitrates subtly—say, from 20 Mbps to 18 Mbps—preventing queues from ballooning. This keeps latency stable, even if visual quality dips momentarily. Dual Queue Coupled Active Queue Management (AQM) ensures fairness, segregating L4S traffic from standard flows without starving either.

Mobile Devices

On the device side, compatibility is key: Only certain Android phones, mainly Samsung models with specific API levels and modem firmware, support this. When the app launches, the phone triggers a policy to route traffic to the dedicated slice.

This technical prowess aligns with the booming cloud gaming market. Gaming is shifting from pricey consoles to accessible cloud services, projected to explode as 5G proliferates. With billions of mobile devices outpacing console installs, the potential is enormous.

NVIDIA’s Blackwell upgrades amplify this: AV1 encoding squeezes better quality into lower bitrates, 240 FPS streaming demands ironclad stability, and Reflex tech minimizes server-side latency. For NVIDIA, whose data center revenues soar, GeForce NOW is a subscription goldmine. Telco partnerships like DT’s are vital, as no server farm can fix a flaky mobile link.

Commercially, DT’s strategy is clever but risky. Eschewing premium fees for the slice itself, it bundles it free with high-end MagentaMobil plans. Through the Magenta Moments app, users get 3-6 months of GeForce NOW Performance tier gratis, after which they pay NVIDIA directly.

Freemium Infrastructure

This “freemium infrastructure” model bets on retention: Gamers hooked on lag-free play stick with DT’s network, boosting loyalty and reducing churn. It’s not about immediate ARPU hikes but long-term stickiness. However, questions linger.

Will trial conversions justify the engineering outlay? Device fragmentation—limited to Samsung for now—could hinder adoption. And while DT avoids direct charges, the model normalizes slicing, paving the way for enterprise SLAs where real money lies: factories paying for guaranteed low-latency connections.

Yet, challenges abound, particularly regulatory ones. European Net Neutrality rules, enshrined in the Open Internet Regulation, prohibit “fast lanes” that favor specific apps. Critics argue DT’s gaming slice discriminates against non-partner services, like Google’s Stadia remnants or Xbox Cloud Gaming. Advocacy groups have already flagged this, potentially triggering investigations by BEREC or national regulators.

DT counters that slicing enhances overall efficiency without degrading other traffic, but precedents like zero-rating battles suggest scrutiny ahead. Technically, scaling L4S requires ecosystem buy-in—apps, devices, and servers must support it—or it remains a niche.

Market Analysis

| Telco | Partner(s) | Key Technologies | Launch/Trial Date | Region | Notes & Similarities to DT |

|---|---|---|---|---|---|

| Singtel | Tencent Games | 5G SA slicing, app-based QoS, latency priority scheduling | Oct/Nov 2025 | Singapore | Dedicated “fast lanes” for <30ms latency; Honor of Kings Cloud via TxStore app; Singtel users get discounts/credits. Mirrors DT’s slicing + bundling for retention. |

| T-Mobile | NVIDIA (GeForce NOW compatible), Qualcomm/Ericsson | L4S on 5G SA core, real-time traffic prioritization | Mid-2025 rollout | USA | Nationwide L4S first; reduces lag/packet loss for cloud gaming; pairs with GeForce NOW for console-like feel. Direct tech parallel to DT’s L4S + slicing. |

| AIS | Huawei | AI-driven customized network modes (slicing implied), real-time adaptation | Ongoing 2025 | Thailand | Lag-free 5G gaming amid emergencies/high load; shifts telco to “tech pioneer.” Echoes DT’s reliability focus via dynamic optimization. |

| Vodafone | Ericsson, Ubitus | 5G SA network slicing trials | 2023 trials (Italy launch 2019) | Europe (UK, Italy, Germany) | Cloud gaming on slices; 88% preferred over 4G. Older but foundational; recent demos at MWC. Less consumer-scale than DT. |

| SK Telecom | Microsoft (Xbox) | 5G cloud streaming | 2020 (evolved) | South Korea | SKT 5GX Cloud Game with Game Pass Ultimate; high 5G gamer engagement. Pioneer but pre-SA slicing era. |

Deep Dives

Singtel-Tencent: Asia’s Slicing Showcase

Singtel’s September 2025 partnership with Tencent targets massive MOBAs like Honor of Kings Cloud, processed entirely in the cloud for instant play on any Android device—no downloads needed. Network slicing creates virtual lanes with Ericsson gear, hitting <30ms latency via 5G-Advanced scheduling. Trials kicked off in October, full TxStore rollout in November, expanding to 30 titles. Singtel subscribers score perks like 55% in-game discounts, boosting ARPU indirectly—much like DT’s free GeForce NOW trials.

T-Mobile: L4S Leads US Charge

T-Mobile’s 2025 L4S deployment on its 5G SA core is tailor-made for cloud gaming, signaling senders to dial back bitrates preemptively during congestion—preventing bufferbloat. It shines with GeForce NOW, delivering stable frames and sharp inputs. No direct bundling, but it enables “console parity” on mobiles, aligning with DT’s tech stack for NVIDIA services.

AIS-Huawei: AI-Infused Resilience

Thailand’s AIS, powered by Huawei’s IntelligentRAN, uses AI for real-time network tweaks, ensuring “lag-free” gaming via custom modes (network slicing architecture). Highlighted in flood recovery and high-demand scenarios, it positions AIS as a 5G innovator—paralleling DT’s congestion-proof promise.

Broader Trends & Laggards

Early adopters like SK Telecom paved the way, but 2025 marked commercial slicing breakthroughs in Europe/Asia. US giants (Verizon, AT&T) focus enterprise slicing (e.g., Verizon’s FWA slices Dec 2025), not consumer gaming yet. Vodafone’s trials (88% user preference for SA gaming) hint at UK/German rollouts, relevant for Scotland. Ericsson/Nokia reports predict $150B annual revenue from such services, with gamers willing to pay $10+ premiums.

Challenges persist: Device compatibility (e.g., Samsung for L4S), net neutrality scrutiny, and ecosystem buy-in. Yet, as 5G SA covers 99% in leaders like DT/Singtel, expect bundling explosions—turning “dumb pipes” into gaming gateways. Watch for UK Vodafone or EE pilots next.

Strategic Conclusion

In essence, 5G+ Gaming is DT’s Trojan Horse: a flashy consumer app to validate slicing for lucrative B2B sectors. Success could inspire global telcos, unlocking 5G’s true potential. Failure might reinforce skepticism about 5G monetization. As of early 2026, early metrics show promise—users report sub-20ms latency in tests—but mass adoption hinges on broader device support and regulatory green lights.

For gamers, it’s a glimpse of console-quality play on the go; for the industry, it’s a blueprint for escaping the dumb-pipe trap. DT’s gamble underscores a broader truth: In a connected world, quality trumps quantity, and partnerships like this could redefine digital entertainment.

Executive Primer

Executive Primer