The telecommunications industry has always been about connection—bridging distances, linking voices, and, more recently, funnelling data across the globe.

The telecommunications industry has always been about connection—bridging distances, linking voices, and, more recently, funnelling data across the globe.

For years, telcos owned the pipes: the physical networks of copper, fiber, and spectrum that carried the world’s communications.

But in the digital age, pipes alone aren’t enough. The real power lies in what flows through them—and how it’s harnessed. Enter cloud computing, the technological tidal wave that’s forcing telcos to rethink their role in a world increasingly dominated by hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

This chapter dives into the beating heart of the techco transformation: the cloud, and why mastering it—or partnering with those who already have—is the make-or-break challenge for telcos today.

The Cloud: A New Foundation

At its core, cloud computing is about abstraction. It takes the messy, capital-intensive world of physical servers, storage, and IT infrastructure and lifts it into a virtual realm of scalability, flexibility, and efficiency. No longer do businesses need to build their own data centers or maintain sprawling hardware fleets.

Instead, they tap into vast, on-demand resources hosted by hyperscalers—companies that have turned computing power into a utility as ubiquitous as electricity. For telcos, this shift is both a threat and an opportunity.

Historically, telcos thrived on their ability to control the end-to-end delivery of services. They owned the networks, managed the hardware, and delivered the connectivity. But the cloud upends that model. Hyperscalers don’t just provide infrastructure; they offer platforms—ecosystems where developers, businesses, and even consumers can build, deploy, and scale applications with unprecedented speed.

AWS’s Elastic Compute Cloud (EC2), Azure’s Kubernetes Service, and GCP’s BigQuery aren’t just tools; they’re engines of innovation that sit atop the telcos’ networks, often rendering the underlying pipes invisible to the end user.

The Hyperscaler Hegemony

The rise of hyperscalers is staggering. As of early 2025, AWS commands over 30% of the global cloud market, with Azure and GCP trailing but growing fast. Together, these three giants account for more than two-thirds of the cloud infrastructure services spend worldwide.

Their dominance isn’t accidental—it’s built on scale, relentless innovation, and a customer obsession that telcos, with their legacy baggage, have struggled to match. Hyperscalers invest billions annually in data centers, AI-driven automation, and edge computing, creating a gravitational pull that draws enterprises, startups, and even governments into their orbit.

For telcos, the hyperscalers represent a paradox. On one hand, they’re competitors, siphoning off value by offering services—like cloud-based VoIP, IoT platforms, and enterprise solutions—that telcos once monopolized. On the other, they’re customers, relying on telco networks to deliver their cloud services to end users. This uneasy symbiosis has sparked a reckoning: can telcos compete with hyperscalers, coexist alongside them, or perhaps even co-opt their strengths to become techcos themselves?

Telcos and the Cloud: A Rocky Start

Telcos weren’t blind to the cloud’s potential. In the 2010s, many launched their own cloud offerings—think Verizon’s Cloud Platform or AT&T’s Synaptic Storage. But these efforts often faltered. Why? They lacked the scale, agility, and developer ecosystems of the hyperscalers.

Building a competitive cloud isn’t just about slapping virtual machines onto existing infrastructure; it’s about creating a platform that attracts third-party innovation, something telcos, steeped in a culture of control, weren’t wired to do. Meanwhile, hyperscalers like AWS rolled out services like Lambda (serverless computing) and S3 (scalable storage), leaving telco clouds looking like relics before they even gained traction.

The numbers tell the story. By 2025, the global public cloud market is projected to exceed $800 billion, with hyperscalers capturing the lion’s share. Telcos, despite their vast networks and customer bases, have barely scratched the surface. Their early missteps taught a hard lesson: in the cloud game, it’s not enough to own the pipes—you need to own the platform, or at least integrate seamlessly with those who do.

The Pivot: Partner, Build, or Blend?

So where does this leave telcos? The path to techco status hinges on how they navigate their relationship with cloud computing and the hyperscalers. Three strategies are emerging.

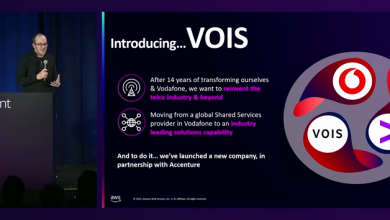

First, there’s partnership. Telcos like Vodafone and Telefónica have inked deals with AWS and Azure to co-deliver cloud services. By integrating hyperscaler platforms with their own networks—think low-latency 5G paired with AWS Outposts or Azure Edge Zones—they’re positioning themselves as indispensable enablers of the cloud economy. This approach leverages telcos’ strengths (connectivity, local presence) while sidestepping the brutal economics of building a hyperscale cloud from scratch.

Second, there’s the build-it-yourself option. A few bold players, like Rakuten Mobile, are betting on fully cloud-native architectures. Rakuten’s greenfield 4G/5G network, launched in 2020, runs entirely on a cloud platform built with partners like Nokia and Altiostar. It’s a radical rethink—ditching legacy hardware for virtualized, software-defined networks that mirror the hyperscalers’ agility. While capital-intensive and risky, this path promises greater control and differentiation.

Finally, there’s the hybrid play: blending proprietary cloud efforts with hyperscaler collaboration. Take BT, which has rolled out its own edge computing services while partnering with GCP to enhance its offerings. This strategy hedges bets, allowing telcos to dip into the cloud’s value pool without fully committing to one camp.

The Stakes: Edge, AI, and Beyond

The cloud isn’t static—it’s evolving, and telcos have a chance to ride its next wave. Edge computing, where data processing moves closer to the user, is a natural fit for telcos’ distributed networks.

Pair that with 5G’s ultra-low latency, and you’ve got a recipe for real-time applications—think autonomous vehicles, smart cities, or immersive AR/VR. Hyperscalers see this too, which is why AWS Wavelength and Azure Edge Zones are already embedding cloud capabilities into telco infrastructure.

Then there’s AI, the cloud’s killer app. Hyperscalers have turned their platforms into AI factories, offering tools like Azure Machine Learning and AWS SageMaker. Telcos, sitting on troves of network and customer data, could harness these tools to optimize operations, predict demand, or personalize services—hallmarks of a true techco.

The Techco Horizon

The cloud isn’t just a technology—it’s a mindset. For telcos, embracing it means shedding the old telco skin of rigid, siloed operations and adopting the techco ethos of agility, openness, and customer focus. Whether they partner with hyperscalers, build their own clouds, or blend the two, one thing is clear: the future of connectivity isn’t about owning the pipes—it’s about mastering the platforms that run on them.

The hyperscalers have set the pace, but telcos, with their unique assets and reach, still have a shot at the race. The question is: will they seize it?

In the chapters ahead, we’ll explore how 5G, AI, and customer-centricity amplify this cloud-driven transformation—and what it takes for telcos to not just survive the hyperscaler age, but to redefine it.